In the fast-evolving world of finance, accountants are under constant pressure to deliver accurate results, meet compliance requirements, and provide valuable strategic insights to clients. Amid tightening regulations, advancing technologies, and growing workloads, effective support for accountants has become essential not just for meeting deadlines, but for driving long-term professional success.

Understanding the Need for Support in the Accounting Profession

Accountants are the backbone of every business. From managing payroll and taxes to preparing financial statements and ensuring compliance, they play a crucial role in maintaining a company’s financial health. However, as the accounting landscape becomes more complex—driven by regulatory changes, digital transformation, and rising client expectations—traditional working methods are no longer sufficient.

That’s where support for accountants comes in. Whether through specialised software, outsourced services, or advisory partnerships, the right kind of support helps accounting professionals focus on high-value work rather than administrative tasks.

Types of Support for Accountants

Accountants require multi-faceted support to manage their workload efficiently and maintain professional accuracy. Let’s explore some of the most valuable forms of support available today.

1. Technological Support

Modern accounting is powered by technology. Cloud-based accounting platforms such as Xero, QuickBooks, and Sage have revolutionised how financial data is managed and shared.

Technological support for accountants includes:

Accounting Software Integration: Automating tasks like invoicing, reconciliations, and reporting.

Cloud Storage: Secure and real-time data access for remote and collaborative work.

AI and Automation: Tools that handle repetitive data entry and flag potential errors.

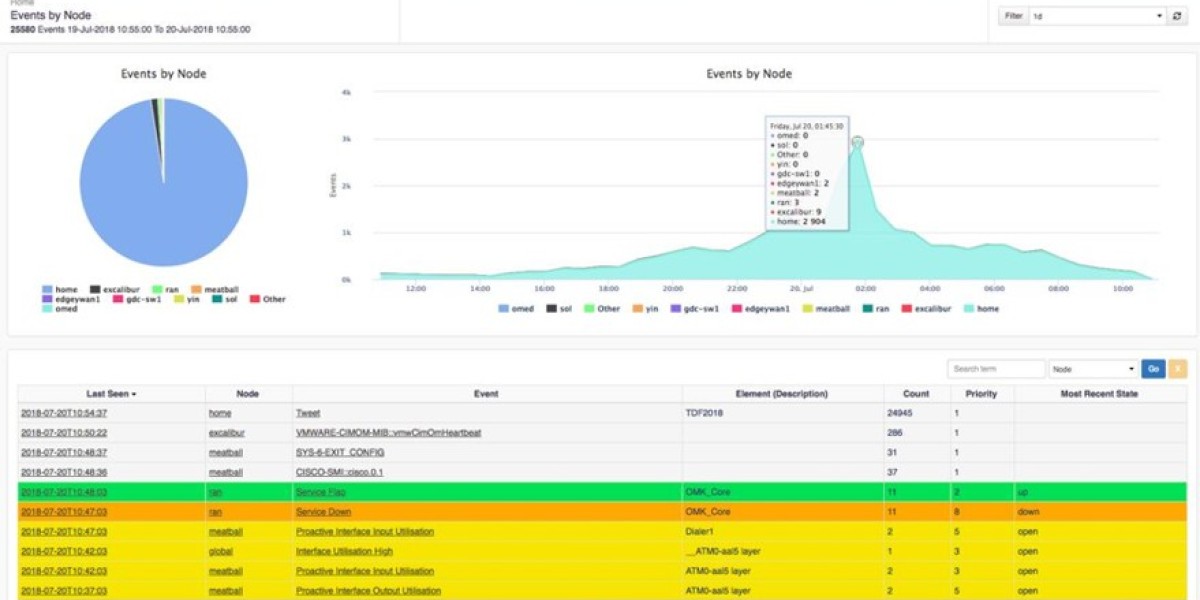

Data Analytics Dashboards: Insights that help accountants advise clients strategically.

Technology not only saves time but also enhances accuracy, ensuring compliance with HMRC regulations and other financial standards.

2. Administrative and Back-Office Support

Administrative responsibilities often take up a large portion of an accountant’s time. Outsourcing or delegating these non-core tasks can dramatically increase efficiency.

Back-office support services may include:

Document management and data entry

Payroll processing

VAT return preparation

Invoice generation and tracking

Client communication management

By outsourcing routine administrative functions, accountants can focus on strategic financial analysis and client advisory services—areas that add the most value.

3. Compliance and Regulatory Support

The UK’s financial regulations evolve constantly, with updates to tax laws, Making Tax Digital (MTD), and audit standards. Staying compliant requires continuous monitoring and education.

Specialised compliance support can include:

Updates on HMRC legislation and reporting requirements

Guidance on GDPR and data protection standards

Audit preparation and advisory services

Access to compliance management software

Professional compliance support ensures that accountants meet all legal obligations and avoid costly penalties for their clients or firms.

4. Continuing Professional Development (CPD) Support

For accountants, professional development is not optional it’s a requirement. Institutes such as the ACCA, ICAEW, and CIMA mandate ongoing CPD to maintain membership and professional standing.

CPD support may come in the form of:

Online training courses

Webinars and workshops on emerging accounting trends

Mentoring and peer collaboration opportunities

Access to professional journals and digital libraries

Investing in continuous learning keeps accountants up to date with changes in taxation, auditing, and business advisory practices, ensuring they deliver the highest level of expertise to clients.

5. Outsourced and Virtual Assistance

Outsourcing has become one of the most practical forms of support for accountants, particularly for small and medium-sized firms. Virtual assistants and offshore accounting teams can handle bookkeeping, tax preparation, and even client communication, allowing UK-based accountants to scale their operations without increasing overhead costs.

Advantages include:

Cost efficiency and reduced staffing pressure

Access to global expertise

Round-the-clock operations

Scalability during busy tax seasons

The Benefits of Professional Support for Accountants

1. Enhanced Productivity

With repetitive and administrative tasks handled by technology or external partners, accountants can dedicate more time to value-driven activities such as financial strategy and business consulting.

2. Improved Accuracy and Compliance

Automated systems and expert support significantly reduce human error. Real-time updates on tax legislation and compliance frameworks ensure accountants stay within the law at all times.

3. Increased Client Satisfaction

Clients expect quick responses, detailed insights, and reliable results. With proper support, accountants can meet these expectations efficiently and deliver superior client service.

4. Reduced Stress and Workload

Tax season and reporting deadlines can be stressful. Support systems whether through automation or outsourcing—help distribute the workload, reducing burnout and improving overall job satisfaction.

5. Scalability and Growth

Support for accountants allows firms to grow without being limited by internal capacity. Outsourcing or adopting scalable software solutions ensures that business expansion doesn’t compromise quality or timeliness.

How to Choose the Right Support System

When evaluating potential support options, accountants should consider several factors to ensure the chosen solution meets their professional needs.

Key considerations include:

Relevance: Does the service or software align with your current workflow and client base?

Security: Is the system GDPR-compliant and capable of safeguarding client data?

Cost vs Value: Will the benefits outweigh the costs in terms of time savings and productivity?

Scalability: Can the solution grow with your firm?

Customer Support: Reliable technical and professional assistance is vital for long-term use.

Before committing to a service or software provider, request demos or trial periods to test usability and compatibility with your practice.

The Role of Technology in Modern Accounting Support

The digital revolution has transformed the way accountants work. Tools that once required manual effort—such as ledger entry, reconciliation, and report generation—are now automated and cloud-based. Artificial intelligence, machine learning, and real-time analytics are shaping the next phase of accounting efficiency.

For instance:

AI-driven auditing tools can detect anomalies in financial statements.

Cloud collaboration platforms enable accountants and clients to work seamlessly, even across borders.

Mobile apps allow professionals to manage finances and approvals on the go.

Technology isn’t replacing accountants—it’s empowering them. By embracing innovation, accountants can spend more time interpreting data and advising clients strategically, rather than performing manual calculations.

Future Trends in Support for Accountants

As the financial industry continues to evolve, several emerging trends are expected to redefine support for accountants in the UK:

Automation of tax reporting and filing through AI-integrated systems

Stronger cybersecurity protocols to protect sensitive financial data

Integration between accounting and HR software for seamless payroll management

Sustainability reporting support, aligning with ESG (Environmental, Social, and Governance) frameworks

Virtual collaboration hubs connecting accountants with clients in real time

Firms that embrace these trends early will position themselves as leaders in efficiency, reliability, and innovation.

Final Thoughts

Accounting is a profession built on precision, trust, and expertise but even the most skilled professionals need the right tools and assistance to thrive in today’s demanding business environment. Reliable support for accountants whether through technology, outsourcing, compliance resources, or ongoing education ensures efficiency, accuracy, and growth.

By adopting modern systems and strategic partnerships, accountants can reduce administrative burdens, improve compliance, and deliver greater value to clients. In the end, effective support doesn’t just make accounting easier it makes it smarter, faster, and more impactful for both professionals and the businesses they serve.